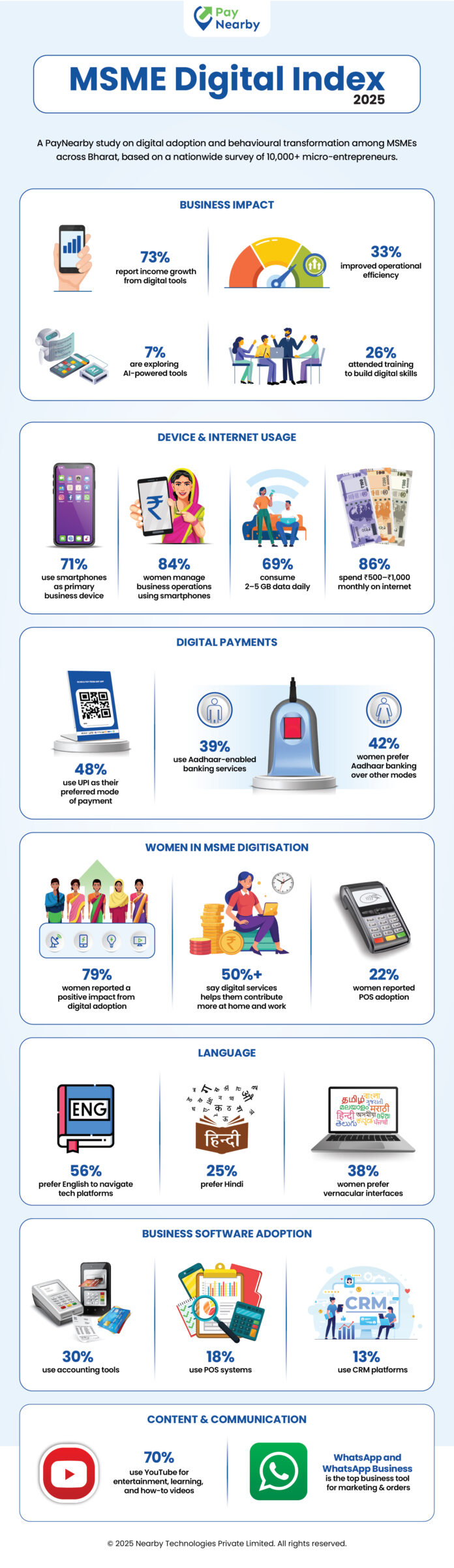

- 48% of MSMEs prefer UPI for digital transactions, with Aadhaar-enabled banking favored by 42% of women entrepreneurs for its secure, biometric features

- 38% of women respondents opt for regional language smartphone interfaces to better connect with their local customer base

- Smartphones are the primary business tool for 71% of MSMEs, rising to 84% among women-led enterprises

- 79% of women entrepreneurs reported a positive impact on their business from adopting digital solutions

- 1 in 4 MSMEs (26%) have taken part in digital skill-building training to enhance operations

- 7% of respondents are already experimenting with AI-powered tools like automated billing, inventory tracking, and customer engagement platforms

Mumbai June 26, 2025 — PayNearby, India’s largest branchless banking and digital network, has unveiled the third edition of its flagship MSME Digital Index Report, revealing significant momentum in digital transformation across semi-urban and rural India. The report finds that over 73% of small businesses have experienced higher income or improved operational efficiency through the adoption of digital tools—marking a strong shift toward digital resilience at the grassroots.

Smartphones, UPI, and Mobile-First Business Models Take the Lead

Insights from the survey—conducted among 10,000 individuals and MSMEs in sectors such as kirana stores, mobile outlets, pharmacies, CSPs, and travel agencies—show that:

- 71% of MSMEs rely on smartphones as their primary business device

- Among women entrepreneurs, smartphone reliance is even higher at 84%, underscoring rising digital comfort

- Daily data consumption has increased, with 69% using between 2GB to 5GB, and 86% spending ₹500–₹1,000 per month on internet access

Digital Payments Drive Trust and Transformation

Adoption of digital transactions continues to accelerate:

- UPI leads as the preferred payment method for 48% of respondents

- Aadhaar-enabled banking follows at 39%, rising to 42% among women entrepreneurs

- These secure, biometric-backed channels are helping micro-entrepreneurs not only improve payment efficiency but also build digital track records, unlocking access to formal credit

“Digital is no longer optional—it’s becoming central to the business model at the last mile,” said a PayNearby spokesperson. “Our latest report shows MSMEs embracing digital for sustainability and growth.”

Emergence of AI and Vernacular Preferences

While still nascent, 7% of MSMEs are experimenting with AI-powered tools such as automated billing, inventory management, and engagement platforms. This early momentum is reflected in growing interest in structured digital workflows like WhatsApp follow-ups and earnings tracking.

Meanwhile, platform language preference is becoming a differentiator:

- 56% prefer English, while 25% prefer Hindi

- Among women, 38% prefer vernacular interfaces, reinforcing the need for regionally localised solutions that are intuitive and culturally relevant

Sustained Impact, Long-Term Opportunity

Digital adoption is yielding clear returns—33% of respondents cite improved operational efficiency, with many seeing growth in sales, customer engagement, and service delivery.

As Bharat’s digital backbone deepens, PayNearby’s MSME Digital Index 2025 reflects a broader trend: grassroots entrepreneurs aren’t just going digital—they’re becoming more agile, confident, and future-ready.