Indilabs.ai, a rapidly growing startup specializing in AI-driven risk management, has received strategic funding from SucSEED Indovation Fund. This capital will accelerate the expansion of Indilabs’ intelligent decisioning platform across key verticals—including banking, lending, and insurance—both within India and in international markets.

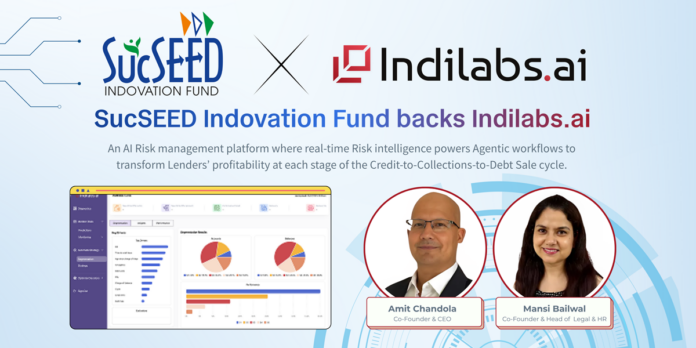

Hyderabad | July 24, 2025 — Early-stage venture capital firm SucSEED Indovation Fund has announced a strategic investment in Indilabs.ai, a rapidly scaling AI-driven risk management startup. This funding will enable Indilabs to accelerate the deployment of its intelligent decisioning platform across lending, banking, and insurance verticals in India and beyond.

Solving Lending’s Profitability Puzzle with AI

Indilabs.ai addresses a pressing need in the financial services industry—modernizing risk management and collections strategies. Its proprietary platform helps lenders:

- Monitor borrower risk in real time

- Generate predictive alerts for potential defaults

- Run A/B/n experiments on collections tactics

- Receive actionable AI recommendations to boost recovery outcomes

Currently used by NBFCs, digital banks, insurance firms, and collections agencies, early pilots have demonstrated measurable improvements in profitability and decision speed.

Experienced Leadership Meets Intelligent Innovation

Founded by Amit Chandola, a risk management veteran with two decades of experience across the US, India, and APAC, Indilabs is building a full-stack platform where real-time intelligence powers agentic workflows across the credit lifecycle.

“Risk intelligence is core to profitable growth, and our platform delivers the precision and flexibility CROs and collections leaders have long needed,” said Chandola.

Investor Confidence and Market Opportunity

“Indilabs is well-positioned to disrupt legacy systems and support India’s credit accessibility ambitions,” said Vikrant Varshney, Co-Founder & Managing Partner at SucSEED Indovation Fund. “With deep founder expertise, a validated product, and tailwinds from regulatory innovation, the company is targeting a rapidly expanding market expected to reach USD 18.43 billion by 2030.”

Fund Strategy and Broader Vision

SucSEED Indovation Fund is a SEBI-registered AIF Cat-I Angel Fund with a ₹300 crore corpus and a portfolio of 65+ startups. It focuses on innovation-led solutions across FinTech, HealthTech, EdTech, RegTech, MSME SaaS, and more. The firm has also launched its GROWTH Fund (Fund-III in GIFT City) for Series A/B investments with global potential.

Indilabs’ integration of AI and operational strategy signals the emergence of smarter, faster, and more scalable risk management models—moving financial institutions closer to real-time decisioning and sustained profitability.